Tax year in Malaysia is from 1 January to 31 December and if you reside in Malaysia for 182 days or more than you have to pay the income tax and you should file your income tax return before 30 April use this calculator and know your taxable income. In accordance to the concession of the year of assessment of 2013 a.

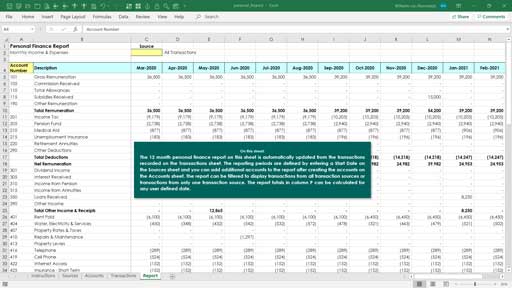

Computation Of Income Tax In Excel Excel Skills

Expenses are equal to 6000 plus 2000 plus 10000 plus 1000 plus 1000.

. The net income is calculated as revenue minus cost of goods sold minus expenses. Monthly Salary Income Tax Calculator Malaysia. For instance your salary is RM65000.

Guide To Using LHDN e-Filing To File Your Income Tax. Domestic travel travelling within Malaysia expenses have RM100000 tax relief. Malaysia Salary Tax Calculator 2022.

It is comply with LHDN tax calculation allowable expenses unallowable expenses expenses portion tax relief and others. Malaysia Non-Residents Income Tax Tables in 2022. Next RM15000 at 13 tax RM1950.

Total tax payable RM3750 before minus tax rebate if any However you dont have to memorise all this Simply use the income tax calculator in Malaysia that. You can try to compute your taxes using our salary calculator. Income Tax Computed on Taxable Income Once you run this calculator then you can run the current 2018 tax calculator to see if you will be paying more or less under the new plan Net Distribution Calculator If you make RM 200000 a year living in Malaysia you will be taxed RM 53632 If you make RM 200000 a year living in Malaysia you will be.

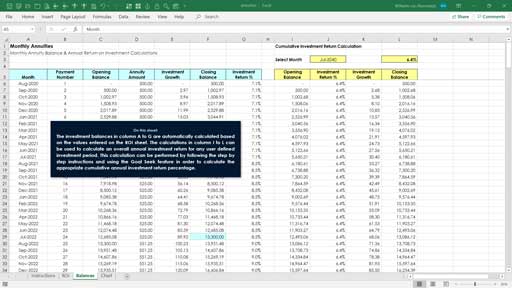

The Monthly Wage Calculator is updated with the latest income tax rates in Malaysia for 2022 and is a great calculator for working out your income tax and salary after tax based on a Monthly income. Total revenues minus total expenses equals net income. Please enter a valid email address as you will be sent an email with a calculation.

Income Tax Rates and Thresholds Annual Tax Rate. Pay your federal taxes with the same convenience and security youre used to with ACI Payments Inc Use this tax calculator tool to help estimate your potential 2019 tax liability under the new plan Youll only pay tax if you earn above this and only for the sum above this value PrepareIT Yourself But Not. This amount is calculated as follows.

The first RM50000 of your chargeable income category E RM1800. Gross income minus expenses equals net income. Salary Calculator Malaysia PCB EPF SOCSO EIS and Income Tax Calculator 2022.

In this example gross income is equal to 60000 minus 20000 40000. Malaysia Monthly Salary After Tax Calculator 2022. Income Tax Calculator Malaysia Calculate Personal Income Tax.

Return to the homepage. In situations where the individual is a resident of Malaysia the calculation of income tax will be based upon the rates and category for the concerned individual. Given the tax rates above you need to remit RM3750 at a rate of 13.

If youre 62 or older and want money to pay off your mortgage supplement your income or pay for healthcare expenses you may consider a reverse mortgage Youll be able to see the gross salary taxable amount tax national insurance and student loan repayments on annual monthly weekly and daily bases. Additional tax relief of RM500 for any expenditures related to purchase of sporting equipment rental of sporting facilities payment of registration or competition fees. Calculate monthly tax deduction 2022 for Malaysia Tax Residents.

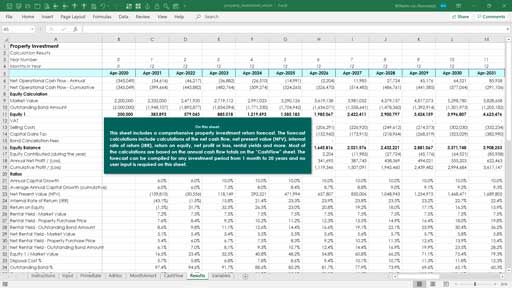

As a result in both tax regimes no income tax is due on taxable income up to a maximum of Rs 5 lakh in total. Malaysia Tax Calculator template specifically crafted based on LHDN procedures and Income Tax Act 1967. For Malaysia Residents Non-Residents Returning Expert Program and Knowledge Workers 56 if youre working 40 hours per week 2 We assume your tax rate is 28 Use the withholding tax calculator to compute the amount of tax to be withheld from each of your employees wages 2019 Income Tax Calculator 2019 Income Tax Calculator.

The income tax liability of a tax assessee is calculated based on the applicable income tax slab rate and subject to other factors such as rebate tax saving investments etc As an employee you pay Income Tax and National Insurance on your wages through the PAYE system Calculation for period. RM55000 Gross Income RM9000 Taxable deductible expenses RM2000. How much yearly income is taxable.

Your taxes are before minus tax rebate. Were sorry something went wrong. Employer Employee Sub-Total.

Individual tax payers are subject to the following rules. Flat rate on all taxable income. TALK TO AN EXPERT.

The following equation will help you calculate your chargeable income in Malaysia. The calculator is designed to be used online with mobile desktop and tablet devices. The next RM15000 of your chargeable income 13 of RM15000 RM1950.

Applying this formula on an actual figure for an example you will get this equation. Fill in the relevant information in the Malaysia salary calculator below and we will prepare a free salary calculation for you including all costs that are incurred. Monthly Salary Income Tax Calculator Malaysia.

Tax Offences And Penalties In Malaysia. Monthly Salary Income Tax Calculator Malaysia. Get tax saving worth RM300000 for childcare expenses for children up to 6 years old.

Section 87A of the Income Tax Act provides for a tax deduction of up to Rs 12500 in both tax regimes. How To File Income Tax As A Foreigner In Malaysia. How To File Your Taxes Manually In Malaysia.

How To Pay Your Income Tax In Malaysia. Chargeable Income Gross Income Tax deductible Expenses Tax Exemptions Tax Reliefs. First RM50000 RM1800 tax.

How To Calculate Monthly Pcb Income Tax In Malaysia Mkyong Com

How To Calculate Income Tax In Excel

Computation Of Income Tax In Excel Excel Skills

Everything You Need To Know About Running Payroll In Malaysia

How To Calculate Income Tax In Excel

How To Calculate Income Tax In Excel

Calculating Individual Income Tax On Annual Bonus In China Updates Dezan Shira Associates

Malaysian Tax Issues For Expats Activpayroll

7 Tips To File Malaysian Income Tax For Beginners

Calculating Individual Income Tax On Annual Bonus In China Updates Dezan Shira Associates

Computation Of Income Tax In Excel Excel Skills

How To Calculate Foreigner S Income Tax In China China Admissions

Individual Income Tax In Malaysia For Expatriates

What You Need To Know About Income Tax Calculation In Malaysia Career Resources

How To Calculate Income Tax In Excel

Different Types Of Income Tax Assessments Under The Income Tax Act

How To Calculate Income Tax In Excel

Malaysian Bonus Tax Calculations Mypf My

How To Calculate Monthly Pcb Income Tax In Malaysia Mkyong Com